Are juicy income funds too good to be true?

If you were approaching retirement and you needed to invest your nest egg into a product that would give you a stable source of income, what would you choose?

This is Canada, so obviously you’re going to put it in an income fund.

Structured products like, YieldMax and other leveraged and covered calls funds are all the rage these days. Even though, as Ben Felix put it, 👇🏽

Ben Felix at PWL Capital.

Most of these funds don’t have a sustainable distribution yield and tend to reduce them over time. The EIT Income Fund ETF from Canoe Financial is a rarity because of its persistence. Its distribution has remained at $0.10/month, though its share price has fluctuated.

Sounds great? Well, Not really.

I first heard of EIT Income Fund back in 2019, when I read an article in the G&M featuring Dan Hallett where he reveals how the fund is able to finance the high, monthly distributions : a mix of dividends and return on capital—which dips into investment capital to make the payout possible.

Dan’s outlook for the fund was not a positive one at the time. But then again, nobody has a crystal ball.

Courtesy of Yahoo! Finance.

The fund’s highs were not during the pandemic. They were during the housing bubble of the 2000s. Levels which have not really recovered.

One reason could be the stock split in April 2009, however the precipitous fall pre-dates that.

This stock split also coincided with the establishment of a $0.10/share distribution that continues today. 👇🏽

Courtesy of Yahoo! Finance.

This persistent distribution has attracted yield hungry Canadians to invest in the fund and there are no shortage of DIYer boomers who see this as an easy way to plan for retirement.

Here is why that is a bad idea:

Much has changed since the G&M’s 2019 article. The unforeseen 2020 Pandemic had a positive impact on the EIT Income Fund—leading to a rocketing rise in share value that continues almost uninterrupted today.

It was not always the case.

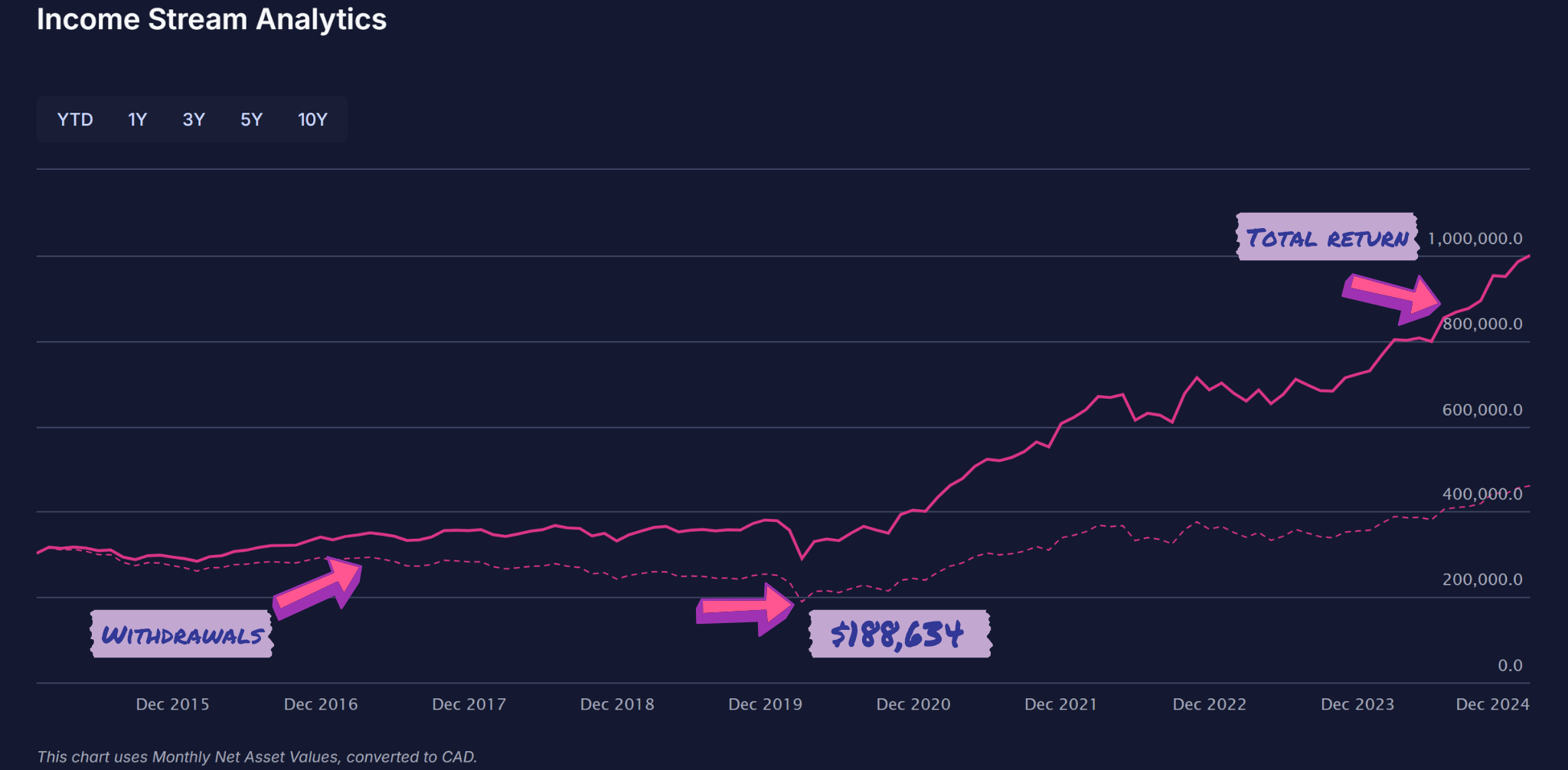

IF you were to invest $300,000 in EIT from 2015 to the 2020. And required a distribution of $1,875/month. A large part of that would have been Return on Capital—dipping into your own principal. Your initial investment would have eroded down to $188,634.

At that rate, your source of retirement income would have PROBABLY not survived another 5 years.

Courtesy of Capintel.

This clearly did NOT what happened.

Since 2020, the fund made a huge turnaround. Boosting the growth of NAV to new heights.

It’s monthly $0.10/share distribution has never been reduced since it’s adoption in 2009.

Other Canadian income funds have had to reduce their juicy distributions as time passed. Dan Hallett’s 2014 blogpost reminds investors of IA Clarington Strategic Income and NEI Northwest Growth & Income funds. Both funds had to abandon their high, level distributions in favor of lower, variable ones.

Lastly, there is one other large red flag: geographic and sector risk concentration.

Canoe EIT is an equity income fund. Unlike a bond fund, which is largely made up of bonds and other fixed income securities in order to deliver a sustainable level of income payments to investors—Canoe is invested in equities—stocks that payout a dividend. And to meet the juicy level of distributions, it concentrates its allocations in companies that pay high dividends.

This means that 48% of the portfolio is allocated to Canada, an economy that makes up 3% of the global market. And 29% of the portfolio is concentrated in financials. With economic warfare looming between the US and Canada and markets already showing turbulence, is parking a large percentage of your nest egg in EIT Income Fund a smart decision?

Corporations are not legally obligated to pay out their dividends and should a corporation go bankrupt, the shareholders have no recourse to recoup their losses. Bond funds have the advantage that interest must be paid by the corporation. They are obligated to do so. Should a corporation go bankrupt then its creditors have a stake at the table when the company’s assets are divided and sold off.

A DIY investor recommending investing everything into a single equity income fund.

Don’t believe everything on the internet.

Today, there are no shortage of extremely online boomers and dividend bros talk about EIT Income Fund as some obvious and safe choice to put your money.

What does good retirement income planning actually look like?

When done right, it starts with a careful analysis of your probable spending needs in retirement. These needs are then met with various sources income: CPP/QPP, OAS, RRSPs or RRIFs, and TFSAs, etc.

The right mix comes from balancing income with tax efficiency, liquidity and potential growth for sustainability throughout retirement. A competent advisor or financial planner can do this using financial planning software. Should inflation rise sharply or should markets tumble, a list of contingency actions are prepared to help you soften the impact.

A mix of products can help, too. GICs and bond funds are common choices. Annuities and tontines can also play a roll in creating a reliable source of steady income—more so than most equity income funds.

Annuities are insurance contracts that payout a predetermined amount of money per year based on the amount invested and current interest rate when the contract is signed. However, you do not get your principal when you pass away.

Tontines are relatively new in Canada. With Purpose Investments and Guardian Capital releasing their own versions of them. Tontines work similar to annuities. But, as time passes and investors die, the survivors gradually receive the earnings from the deceased—increasing their payout rate over time.

If you are wondering why anyone would purchase an annuity or a tontine, it is similar to a Defined Benefit Contribution which also does not payback the invested principal. Nevertheless, new hybrid products are available that can offer a stable payout of income and a return on principal.

When you have access to competent advisors plus a large and growing product shelf, why risk your well-being in retirement with something as risky as EIT Income Fund?